Futures Months

- January – F

- February -G

- March – H

- April – J

- May – K

- June – M

- July – N

- August Q-

- September – U

- October – V

- November – X

- December – Z

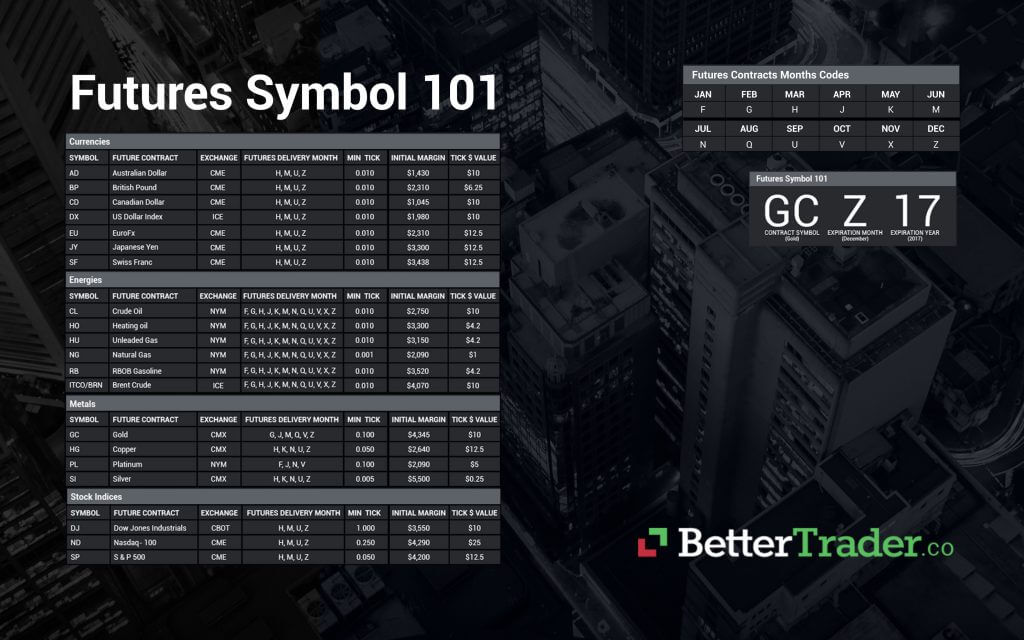

Futures Contracts Months Codes

| JAN | FEB | MAR | APR | MAY | JUN |

|---|---|---|---|---|---|

| F | G | H | J | K | M |

| JUL | AUG | SEP | OCT | NOV | DEC |

|---|---|---|---|---|---|

| N | Q | U | V | X | Z |

Futures Symbols 101

| GC | Z | 17 |

|---|---|---|

| CONTRACT SYMBOL (Gold) | EXPIRATION MONTH (December) | EXPIRATION YEAR (2017) |

For example, a gold future that expires in December 2017 would have the symbol: GCZ17 (GC December 2017).

Futures Symbols 101

| GC | Z | 17 |

|---|---|---|

| CONTRACT SYMBOL (Gold) | EXPIRATION MONTH (December) | EXPIRATION YEAR (2017) |

In the world of trading futures there are many different letters and symbols that correspond to different futures contracts, months of expiry, and exchanges which are denoted on the following graphics.

Futures Month Symbols

Futures Contracts Months Codes

| JAN | FEB | MAR | APR | MAY | JUN |

|---|---|---|---|---|---|

| F | G | H | J | K | M |

| JUL | AUG | SEP | OCT | NOV | DEC |

|---|---|---|---|---|---|

| N | Q | U | V | X | Z |

Below you can find the symbols associated with each month of expiry for future contracts. While the letters might seem erratically dispersed, this is most likely because the preceding letters already have associations in trading contexts ( A= Ask, B= Bid, C= Corn, E=Eggs, O= Oats, S= Soybeans, W= Wheat etc.). This leaves the remaining letters to be served for the months of the year. However, the original future trading commodities dealt with agricultural resources, therefore corn and wheat are represented, while crude oil is not. While this explanation seems probable, there is no definitive reason for the denotations but they are still globally accepted as the correct symbols.

Futures Specification

What is "Min Tick"?

Min Tick is the minimum movement that is captured for a given instrument. For instance if the Tick is 0.01 this means the minimum price movement that will be recorded is 0.01. For example CL (the futures contract for oil) is trading today at 67.01 and the minimum change in price that will be recorded is from 67.01 to 67.02 or from 67.01 to 67.00 this is the definition of Min Tick being 0.01

What is "Tick Value"?

This means how much each tick movement is worth. For example assume we are talking about the futures contract for oil which is denoted as CL. The definition of the oil contract size is for 1000 barrels . Thus since the "Tick" is 0.01 the tick value is equal to the contract size multiplied by minimum tick, in our oil contract example 0.01*1000 =$10. In summary; Tick Value = Tick*Contract Size.

Futures Symbol List

Stock Indices

| SYMBOL | FUTURE CONTRACT | EXCHANGE | FUTURES DELIVERY MONTH | MIN TICK | INITIAL MARGIN | TICK $ VALUE |

|---|---|---|---|---|---|---|

| DJ | Dow Jones Industrials | CBOT | H, M, U, Z | 1.000 | $3.550 | $10 |

| ND | Nasdaq 100 | CME | H, M, U, Z | 0.250 | $4.290 | $25 |

| SP | S&P 500 | CME | H, M, U, Z | 0.050 | $4.200 | $12.5 |

Below you can find the symbols associated with every kind of futures contract, where they are exchanges, the month of delivery, the minimum tick size/price shift, and the $-value (amount of profit or loss incurred with each tick). You can also find the initial margin of each future contract, which signifies the minimum amount to be available in your account as a collateral for each contract that you have open position on. When you purchase a futures contract, the initial margin is the minimum amount of money that must be deposited into your account which is refunded with any gains or losses when your contract is liquidated. The amount in this margin account fluctuates daily in response to the market in relation to your futures contract.

Currencies Futures Symbols

Currencies

| SYMBOL | FUTURE CONTRACT | EXCHANGE | FUTURES DELIVERY MONTH | MIN TICK | INITIAL MARGIN | TICK $ VALUE |

|---|---|---|---|---|---|---|

| AD | Australian Dollar | CME | H, M, U, Z | 0.010 | $1.430 | $10 |

| BP | British Pound | CME | H, M, U, Z | 0.010 | $2.310 | $6.25 |

| CD | Canadian Dollar | CME | H, M, U, Z | 0.010 | $1.045 | $10 |

| DX | US Dollar Index | ICE | H, M, U, Z | 0.010 | $1.980 | $10 |

| EU | EuroFx | CME | H, M, U, Z | 0.010 | $2.310 | $12.5 |

| JU | Japanese Yen | CME | H, M, U, Z | 0.010 | $3.300 | $12.5 |

| SF | Swiss Franc | CME | H, M, U, Z | 0.010 | $3.438 | $12.5 |

Energies Futures Symbols

Energies

| SYMBOL | FUTURE CONTRACT | EXCHANGE | FUTURES DELIVERY MONTH | MIN TICK | INITIAL MARGIN | TICK $ VALUE |

|---|---|---|---|---|---|---|

| CL | Crude Oil | NYM | F, G, H, J, K, M, N, Q, U, V, X, Z | 0.010 | $2.750 | $10 |

| HO | NY Harbor ULSD/Heating oil | NYM | F, G, H, J, K, M, N, Q, U, V, X, Z | 0.010 | $3.300 | $4.2 |

| HU | Unleaded Gas | NYM | F, G, H, J, K, M, N, Q, U, V, X, Z | 0.010 | $3.150 | $4.2 |

| NG | Natural Gas | NYM | F, G, H, J, K, M, N, Q, U, V, X, Z | 0.001 | $2.090 | $1 |

| RB | RBOB Gasoline | NYM | F, G, H, J, K, M, N, Q, U, V, X, Z | 0.010 | $3.520 | $4.2 |

| ITCO/BRN | Brent Crude | ICE | F, G, H, J, K, M, N, Q, U, V, X, Z | 0.010 | $4.070 | $10 |

Meats Futures Symbols

Meats

| SYMBOL | FUTURE CONTRACT | EXCHANGE | FUTURES DELIVERY MONTH | MIN TICK | INITIAL MARGIN | TICK $ VALUE |

|---|---|---|---|---|---|---|

| FC | Feeder Cattle | CME | F, H, J, K, Q, U, V, X | 0.025 | $4.263 | $12.5 |

| LC | Live Cattle | CME | G, J, M, Q, U, V, Z | 0.025 | $2.255 | $10 |

| HE | Lean Hogs | CME | G, J, K, M, N, Q, V, Z | 0.025 | $1.320 | $10 |

| DA | Milk class III | CME | F, G, H, J, K, M, N, Q, U, V, X, Z | 0.010 | $1.300 | $20 |

Grains & Soy Complex Futures Symbols

Grains & Soy Complex

| SYMBOL | FUTURE CONTRACT | EXCHANGE | FUTURES DELIVERY MONTH | MIN TICK | INITIAL MARGIN | TICK $ VALUE |

|---|---|---|---|---|---|---|

| BO | Soybean Oil | CBOT | F, H, K, N, Q, U, V, Z | 0.010 | $935 | $6 |

| C | Corn | CBOT | F, H, K, N, U, X, Z | 0.250 | $935 | $12.5 |

| KW | Kansas City Wheat | KCBT | H, K, N, U, Z | 0.250 | $1.250 | $12.5 |

| MW | Minneapolis Wheat | MGE | H, K, N, U, Z | 0.250 | $2.250 | $12.5 |

| O | Oats | CBOT | H, K, N, U, Z | 0.250 | $880 | $12.5 |

| S | Soybeans | CBOT | F, H, K, N, Q, U, X | 0.250 | $2.310 | $12.5 |

| SM | Soybeans Meal | CBOT | F, H, K, N, Q, U, V, Z | 0.100 | $1.980 | $10 |

| W | Wheat | CBOT | H, K, N, U, Z | 0.250 | $1.320 | $12.5 |

Metals Futures Symbols

Metals

| SYMBOL | FUTURE CONTRACT | EXCHANGE | FUTURES DELIVERY MONTH | MIN TICK | INITIAL MARGIN | TICK $ VALUE |

|---|---|---|---|---|---|---|

| GC | Gold | CMX | G, J, M, Q, V, Z | 0.100 | $4.345 | $10 |

| HG | Copper | CMX | H, K, N, U, Z | 0.050 | $2.640 | $12.5 |

| PL | Platinum | NYM | F, J, N, V | 0.100 | $2.090 | $5 |

| SI | Silver | CMX | H, K, N, U, Z | 0.005 | $5.500 | $0.25 |

Interest Rates Futures Symbols

Interest Rates

| SYMBOL | FUTURE CONTRACT | EXCHANGE | FUTURES DELIVERY MONTH | MIN TICK | INITIAL MARGIN | TICK $ VALUE |

|---|---|---|---|---|---|---|

| ED | Eurodollars | CME | H, M, U, Z | 0.005 | $3.850 | $12.5 |

| FV | 5-Yr T-Notes | CBOT | H, M, U, Z | 0.016 | $770 | $15.625 |

| MB | Municipal Bonds | CBOT | H, M, U, Z | 0.031 | $3.150 | $31.25 |

| TU | 2-Yr T-Notes | CBOT | H, M, U, Z | 0.008 | $462 | $15.625 |

| TY | 10-Yr T-Notes | CBOT | H, M, U, Z | 0.016 | $1.430 | $15.625 |

| US | 30-Yr T-Notes | CBOT | H, M, U, Z | 0.031 | $3.850 | $31.25 |

Soft and Fibers Futures Symbols

Soft & Fibers

| SYMBOL | FUTURE CONTRACT | EXCHANGE | FUTURES DELIVERY MONTH | MIN TICK | INITIAL MARGIN | TICK $ VALUE |

|---|---|---|---|---|---|---|

| RR | Rice | CBOT | F, H, K, N, U, X | 0.500 | $975 | $50 |

| CC | Cocoa | ICE | H, K, N, U, Z | 1.000 | $1.595 | $10 |

| CT | Cotton | ICE | H, K, N, U, Z | 0.010 | $2.530 | $5 |

| KC | Coffee | ICE | H, K, N, U, Z | 0.050 | $2.970 | $18.75 |

| LB | Lumber | CME | F, H, K, N, U, X | 0.100 | $1.595 | $11 |

| JO | Orange Juice | ICE | F, H, K, N, U, X | 0.050 | $1.600 | $7.5 |

| SB | Sugar #11 | ICE | H, K, N, V | 0.010 | $1.232 | $11.2 |

Interested in enhancing your trading experience? Discover how AI can elevate your strategies by reading our latest post about AI Trader Copilot – your ultimate trading assistant – here