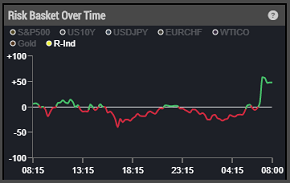

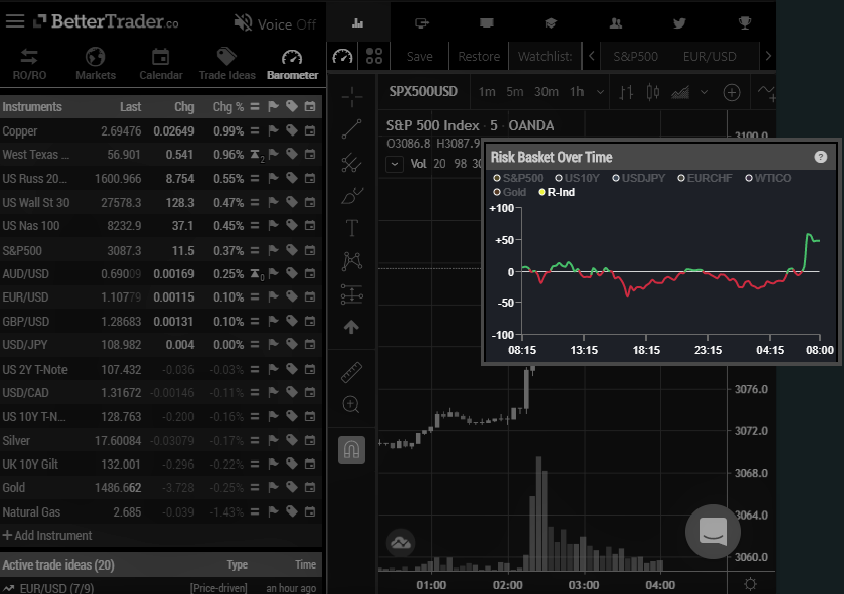

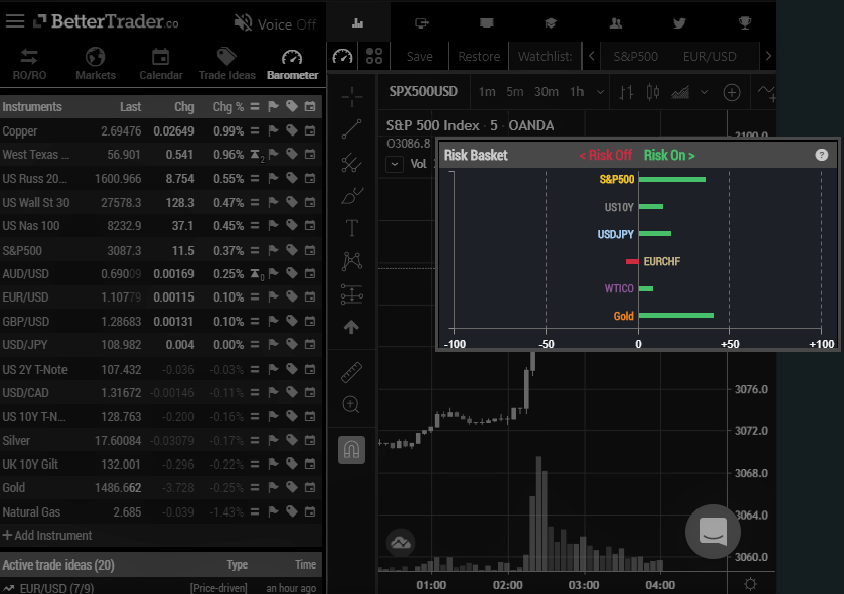

Gauge the overall sentiment of the market

The Risk-ON/Risk-OFF analysis will help you measure relative risks of specific asset classes to gauge the overall sentiment of the market and make trades best suitable to the conditions evaluated. It is a more efficient way to view the relationships between asset classes – a cumbersome task trader do every day.