How A Single Tweet Shook The Oil Markets

A single tweet often seems inconsequential - unless it comes from the President of the United States. President Trump sent out this tweet last week after Iran shot down a US military drone, amidst rising tensions after Iran allegedly attacked 6 oil tankers near the Gulf of Oman. Read this case study to find out how a simple tweet managed to shake the oil markets and how you can be prepared the next time it happens.

A single tweet often seems inconsequential - unless it comes from the President of the United States. President Trump sent out this tweet last week after Iran shot down a US military drone, amidst rising tensions after Iran allegedly attacked 6 oil tankers near the Gulf of Oman. Read this case study to find out ... how a simple tweet managed to shake the oil markets and how you can be prepared the next time it happens.

1 tweet

5.5%increase in WTI price

Overview

Many speculated that this tweet signaled the President’s plan to retaliate against Iran.

With Iran being a major oil producing country, US sanctions against Iran spell a tightening supply of oil globally. Furthermore, a third of global oil is shipped through the Strait of Hormuz, which coincidentally is where the American drone was shot down. Given Iran’s past threats to close off access to the Strait, tensions between the two nations mean that oil prices could skyrocket further. As such, countries and investors alike rushed to stockpile oil, causing the West Texas Intermediate crude to jump to a price of $57 per barrel (see Fig. 1, click to enlarge the image).

Fig. 1: WTI Price Increase After Trump’s Tweet

Fig. 1: WTI Price Increase After Trump’s Tweet Source: Markets Insider

As you can see, WTI prices were relatively stable leading up to Trump’s tweet at 7:15am. Seeing as Fig. 1 (click to enlarge the image) is a 5-minute candlestick chart, the first 5 minutes following his tweet was the best time to long the WTI. A trader who was paying attention and caught Trump’s tweet in time to observe the market’s reaction would have been able to react fast.

An initial reaction time of 5 minutes would mean close to zero risk-time given that prices rose consistently until 9pm the same day. Thus, the trader would be in a better mental state than someone who longs at 7:40am only to see prices fall over the next few hours before spiking again at 2pm. A trader who survives the price volatility until 2pm or better yet, 9pm, would stand to make almost 5.5% in profits. Thus, being able to react to such events in real-time positions traders to make lucrative trades whilst those who can’t miss out on trading opportunities and potentially stand to suffer losses.

The Problem

The movements in the WTI occurred mere minutes after Trump sent out that tweet, catching many commodities traders off guard. Most people would not have notifications set to catch his tweets and day traders often do not have time to check their screen notifications while at work.

Furthermore, staring at Twitter all day is very tiring and one has to constantly avoid the distractions typical of a social media platform. Traders who are less social-media-savvy may not even realize the impact that tweets can have. As such, many traders would have missed out on a lucrative deal trading oil and perhaps been shocked when the high oil prices made the news after a few hours had passed.

Modern Problems Require Modern Solutions: Introducing our Twitter Scanner™ - Voice Assistant Pair

Unexpected tweets and news can impose huge movements on markets. So how can traders prepare for such events in the future? It’s simple, really.

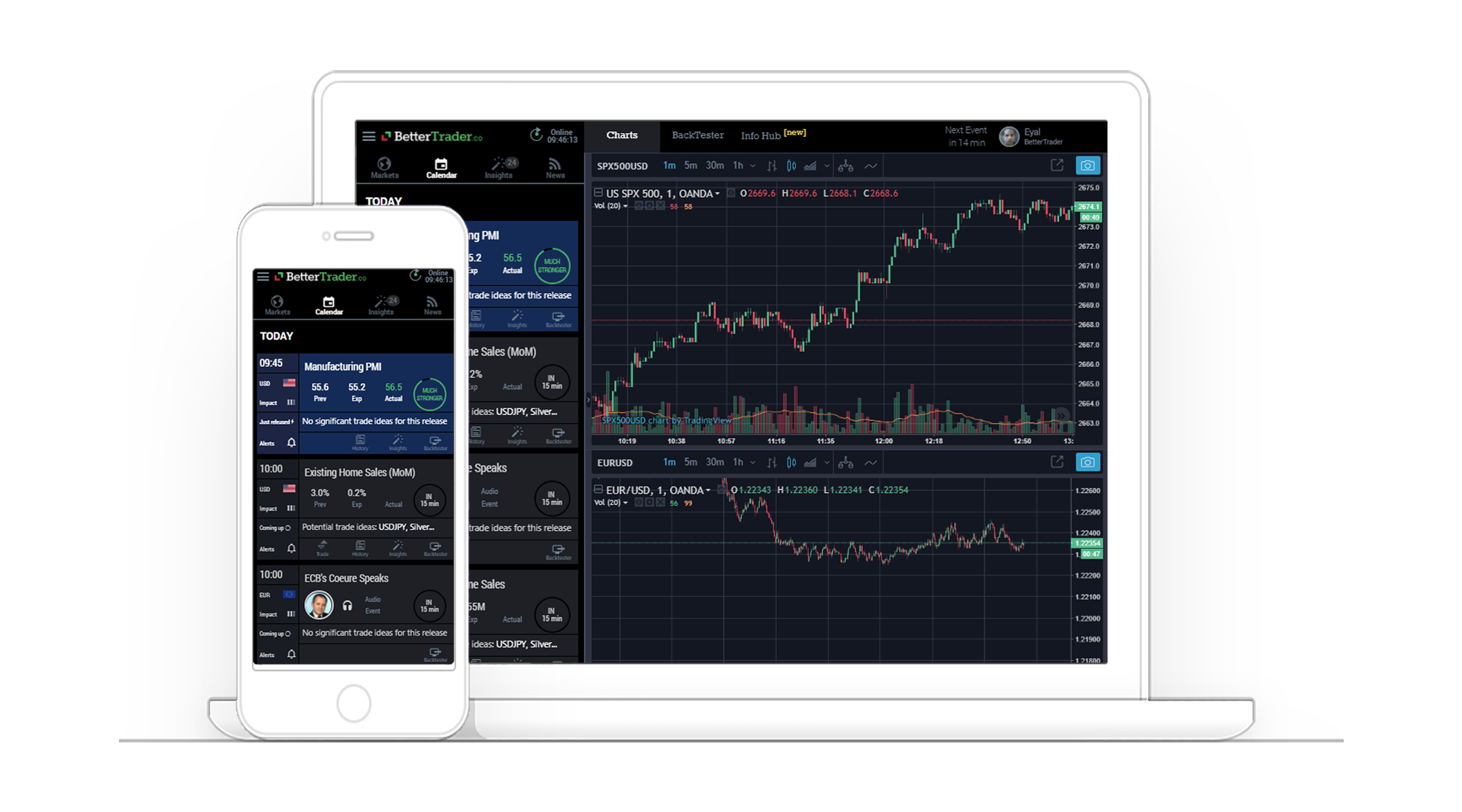

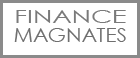

Here at BetterTrader, we designed our Twitter Scanner™ and Voice Assistant with these situations in mind. Our Twitter Scanner™ allows you to follow only the most important news sources and influential people (see Fig. 2, click to enlarge the image). Its integration within our platform means that you can switch from our economic calendar and charts with just one click.

Fig. 2: Snapshot of BetterTrader’s Twitter Scanner™

Fig. 2: Snapshot of BetterTrader’s Twitter Scanner™ Source: BetterTrader

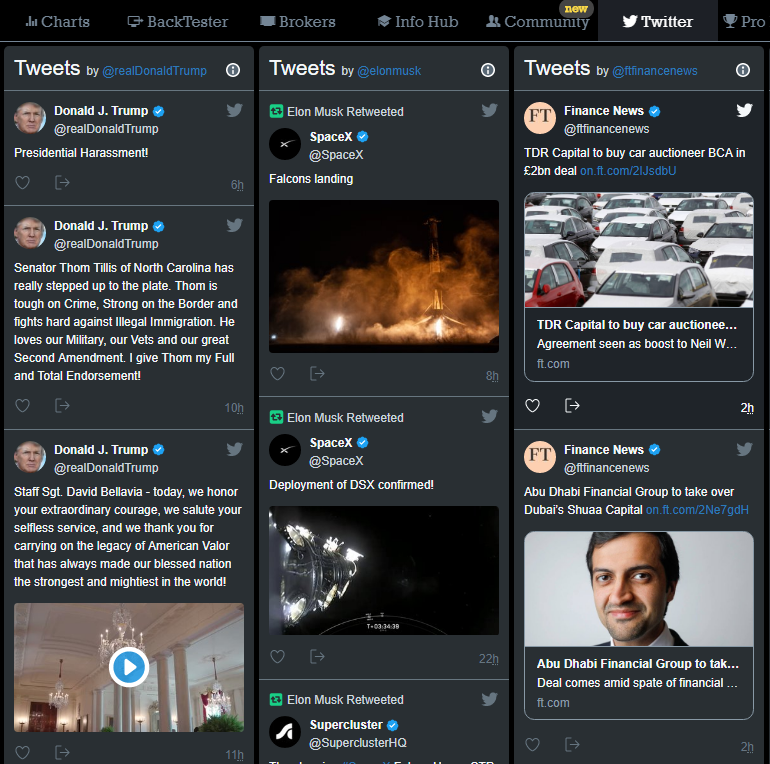

Too busy to look at your screen? Our Voice Assistant will alert you of and even read out new tweets from people you follow (see Fig. 3, click to enlarge the image). Besides tweets, you can also get voice alerts for upcoming economic events, trade ideas and on significant market movements.

Fig. 3: Customization Screen for Voice Assistant

Fig. 3: Customization Screen for Voice AssistantSource: BetterTrader

Read More BetterTrader Case Studies

Back to case studiesThis is what our Pro Membership Clients say about us...

BetterTrader is used extensively by professional traders as well as enthusiastic beginners.