Unemployment Rate And Its Effect On The S&P 500: It's Less Intuitive Than You Think

Economic event releases are curveballs to unprepared and inexperienced traders, resulting in emotional and frantic trading that lead to great losses. So how can we avoid this? Read on to find out how you can prepare for the next macroeconomic event and maximize your profits.

Economic event releases are curveballs to unprepared and inexperienced traders, resulting in emotional and frantic trading that lead to great losses. So how can we ... avoid this? Read on to find out how you can prepare for the next macroeconomic event and maximize your profits.

11 times Unemployment was higher than expected

3 years time-frame of our analysis

Overview

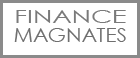

Macroeconomic events can have big impacts on markets. As traders, we need to be prepared to react to any changes in the economy. Fig. 1 (click to enlarge the image) shows the unemployment rate in the United States over the last 70 years. We see that the unemployment rate has been falling in recent years, but that spells a future trend of rising unemployment as it will never fall to 0%.

Fig. 1: US Unemployment Rate

Fig. 1: US Unemployment Rate Source: U.S. Bureau of Labor Statistics

The Problem

With big impact often comes big confusion. The release of the unemployment rate causes a lot of volatility in the markets, and it is often unclear which markets are most affected by its release. Even the most experienced trader can find themselves confused. One key example of this is how traders react to a surprising rate of unemployment, and its predicted impact on the S&P 500.

Take a negative event, a release of a higher than expected unemployment rate, for instance. When the unemployment rate is surprisingly higher than expected, fewer people are employed, so the overall income consumers receive will be lower. Logically, with less income, people will spend less money, and thus the demand for products will fall. In general, this causes stock prices to fall, although the extent of this fall is industry-dependent. The expectation of most traders then is that, with the release of higher than expected unemployment, the S&P500 will go down.

But here’s the kicker: the S&P500 is inversely related to the unemployment rate, and thus the market actually goes up as a response to a release of a higher than expected unemployment rate. This may seem illogical conceptually, but historical analysis and statistics show that it is true.

In the last 3 years, the unemployment rate in the United States has been surprisingly higher than expected 11 times. The result? The S&P500 went up 80% of those times within a time-frame of 90 minutes (see Fig. 2, click to enlarge the image).

Fig. 2: Previous 11 trades for S&P500, after a surprisingly higher than expected unemployment release

Fig. 2: Previous 11 trades for S&P500, after a surprisingly higher than expected unemployment release Source: BetterTrader

But why? Well, it is likely that the market reacts to the higher than expected unemployment rate by cutting back on spending. This encourages looser monetary policies in the form of low interest rates by the Central Bank. Low interest rates then create an inflow of money into higher-risk assets like the stock market.

So what? How can I profit from this? With adequate preparation, traders can profit from such events. Buying after the release and holding for 30-90 minutes can lead to gains (see Fig. 3, click to enlarge the image).

Fig. 3: Example of a winning trade

Fig. 3: Example of a winning tradeSource: BetterTrader

What we can take away from this example is that there are various possible impacts that an economic event can have on a market. As traders, our job is to discern which impact is the most plausible based on the current narrative or economic outlook.

As humans, it is near impossible to recall what we ate for lunch two weeks ago, let alone recalling historical economic events from years ago to aid our present judgment.

The BackTesting Solution

Keeping up with economic events in and of itself is hard enough, and it is harder still to predict their impacts on markets. As humans, it is near impossible to recall what we ate for lunch two weeks ago, let alone recalling historical economic events from years ago to aid our present judgment. That is why we created our BackTester tool.

BackTesting is generally defined as the process of applying a trading strategy or analytical method to historical data to see how accurately the strategy or method predicts actual results. The tool employs artificial intelligence to generate trade analysis based on similar historical events. It prepares you well before an event release and provides a snapshot of the market reaction in similar situations. Using our BackTester will give you the edge you need to trade economic events and price actions.

Read More BetterTrader Case Studies

Back to case studiesThis is what our Pro Membership Clients say about us...

BetterTrader is used extensively by professional traders as well as enthusiastic beginners.