Once the news is released, you will be in a different situation. The markets start immediately to move faster, become more volatile, and sometimes without logic that we understand at that point. To trade in that situation we must do three things:

- Understand the new information

- Analyze that information

- Plan for the trade

Proprietary tools to deal with economic events

- Surprise Magnitude - Once an economic event occurs, you can see the magnitude of surprise. Just click the event in the Calendar, and BetterTrader interprets whether the release was stronger or weaker than expected, and by how much.

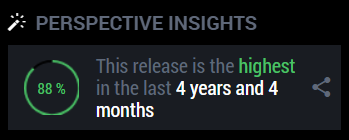

- Perspective Insight - Descriptive statistics summarize how this actual release compares to past releases.

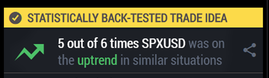

- Statistically Backtested Trade Idea - - BetterTrader uses historical data to see how markets have reacted to similar situations in the past.

- Surprise range - the range of stronger and weaker releases relative to expectations.

Now, when the event occurs, and once you have understood the new information, you already know which market to trade and in which direction. So you are prepared to enter your trade immediately to capture a profit from the expected volatility.

Now, when the event occurs, and once you have understood the new information, you already know which market to trade and in which direction. So you are prepared to enter your trade immediately to capture a profit from the expected volatility.

For example, you could already know how much the release is surprising if the GDP expectation is 2.2% and the actual value is 2.8%. If the release is Much Stronger (than the expected value), you already know the best market to trade and are ready to execute the trade. Or if the release is anything less than Much Stronger, you would know that it would be most prudent to skip the trade. Many wise traders have noted that a key to long-term success is to avoid forcing trades that are less than ideal.

To know that this is the highest in the last 4 years and 4 months helps you to get the perspective, and the fact that 5 out of 6 times the S&P 500 moved up following similar releases, supports your idea to buy the index.

What remains is to form a plan for how to trade, also known as executing the trade. In the next chapter, we will present a bit about trade execution.

Takeaway

We as traders need a system to rely on when there is no time to research and weigh the risks and benefits of every move. It doesn’t matter if you use a paper system or a computerized system, you just need a system that works for you.