The Gulf of Oman Attack And How It Impacted Brent Crude Prices

World oil prices surged dramatically following reports that two oil tankers had been attacked in the Gulf of Oman. Tensions were high in the Middle Eastern region, with the US Secretary of State Mike Pompeo blaming Iran for the attacks, sparking concerns of a full-blown US-Iran war. Investors and countries have rushed to stockpile oil in fear of future shortages if Iran, the 5th largest global oil producer, were to be embroiled in a war. So, how can traders keep up with such unexpected changes in markets and trade in a profitable direction amidst all the noise? Read this case study to find out.

World oil prices surged dramatically following reports that two oil tankers had been attacked in the Gulf of Oman. Tensions were high in the Middle Eastern region, with the US Secretary of State Mike Pompeo blaming Iran for the attacks, sparking concerns of a full-blown US-Iran war. Investors and countries have rushed to stockpile oil in fear of future shortages if Iran, the 5th largest global oil ... producer, were to be embroiled in a war. So, how can traders keep up with such unexpected changes in markets and trade in a profitable direction amidst all the noise? Read this case study to find out.

1 drone attack

6%increase in Brent Crude price

Overview

Following the reported attacks, new sites broke the news via Twitter. Bloomberg Market’s Twitter account, one of the leading platforms for traders to find instantaneous reports on the latest financial news, tweeted about the attacked on the 13th of June at 2:18am (see Fig. 1, click to enlarge the image).

Fig. 1: Bloomberg’s Tweet (2:18am)

Fig. 1: Bloomberg’s Tweet (2:18am) Source: Twitter, Bloomberg Markets

Brent Crude prices began rising mere minutes after the tweet as traders rushed to enter the market and bought oil (see Fig. 2, click to enlarge the image).

Fig. 2: Brent Crude Oil Price (13 June 2019)

Fig. 2: Brent Crude Oil Price (13 June 2019) Source: Trading View

The market was relatively stable before the tweet, hovering at an average price of $51.20. However, prices spiked immediately after the tweet until 2:40am where prices began to dip. A trader who had been paying attention to Bloomberg’s account and entered the market between 2:18am and 2:28am would have faced zero drawdown time given that Brent prices remained higher and eventually peaked at $53.30 at 8:00am. The trader who faces low/zero drawdown time by entering the market early would have been able to survive the price volatility to profit from Brent peaking at $53.30, resulting in a 5-6% profit.

On the other hand, late traders who entered the market after 7:35am would have faced a high drawdown time as prices dipped sharply at 7:40am. Thus, traders have to be able to react to such events in real-time in order to make a lucrative trade. Those who react too slowly stand to lose out on such trading opportunities and might even suffer losses.

The Problem

Brent Crude prices rose almost immediately after Bloomberg’s tweet, leaving commodities traders with a small 10-minute window to make a lucrative trade. Traders who prefer traditional news mediums like newspapers would only notice the price movements many hours after the event. Even social media savvy traders might have missed the tweet given that Bloomberg Markets posts dozens of tweets each day. As such, many traders would have missed out on a profitable trade.

Our Solution: The Twitter Scanner™ - Voice Assistant Pair and Price-Driven Trade Ideas

As you can see, unexpected news can have a great impact on markets. How then can traders prepare for these events?

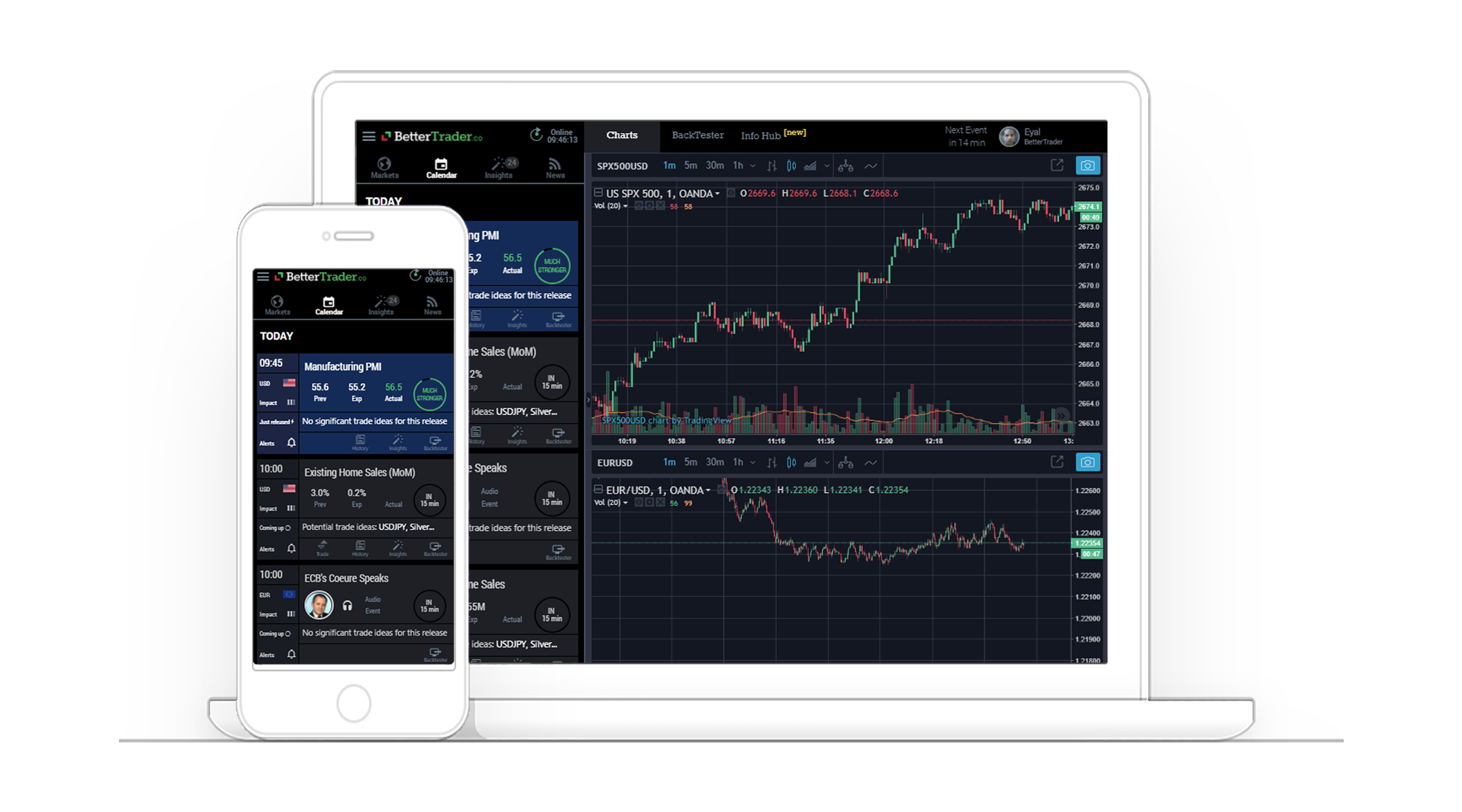

Our earlier case study, How a single tweet shook the oil markets, went in-depth into how our Twitter Scanner™ and Voice Assistant pair can help traders profit from such events. Our Twitter Scanner™ allows you to follow only the most important news sources and influential people. The Voice Assistant notifies you of the latest news by announcing sudden price movements and reading tweets in real-time. The combination of these two features makes it hard to miss tweets about the latest financial news and events.

However, certain price movements cannot be caught by news sites and reported in time for traders to enter the market in time. As such, the pair is most effective when used with our Trade Ideas, in particular our Price-Driven Trade Ideas which suggest the markets and direction in which you should trade.

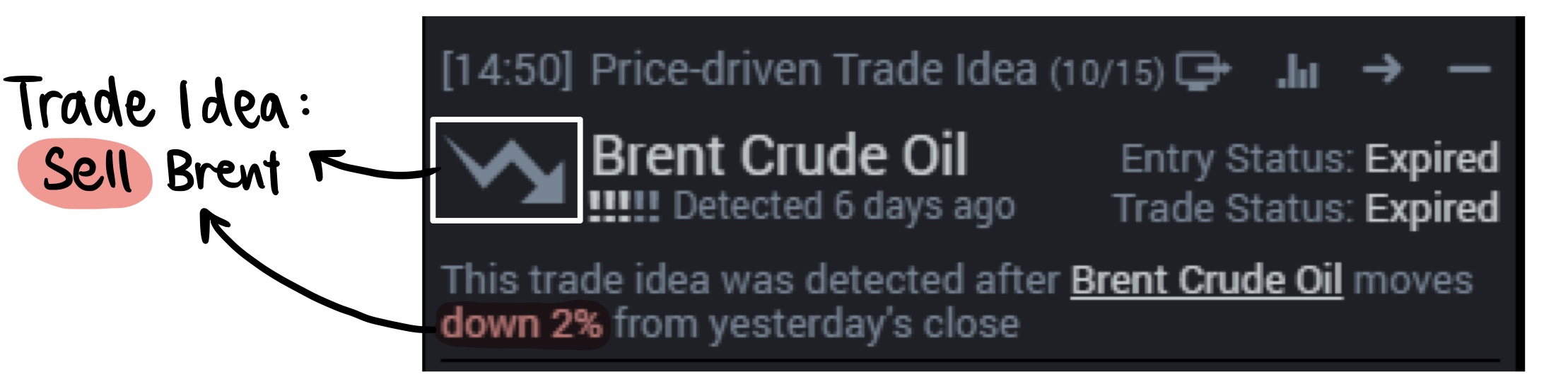

Fig. 3: Price-driven Trade Idea

Fig. 3: Price-driven Trade Idea Source: BetterTrader

For instance, a consistent 2% fall in Brent Crude price triggered a trade idea to sell Brent in anticipation of lower prices in the next few minutes or hours (see Fig. 3, click to enlarge the image). Trade Ideas are typically only active for a few minutes as that is the average window of opportunity for trading.

In the case of the oil tanker incident (see Fig. 1, click to enlarge the image), the 5 consecutive green candles from 2:10am to 2:30am would have triggered a Trade Idea to buy Brent and sell at a higher price in anticipation of higher prices in the future. Hence, Trade Ideas are incredibly useful in informing traders of opportunities that news sites have yet to detect.

Read More BetterTrader Case Studies

Back to case studiesThis is what our Pro Membership Clients say about us...

BetterTrader is used extensively by professional traders as well as enthusiastic beginners.